February is like the Tuesday of all the months. We made it through the first month of 2024, but now we’re in that weird limbo of “not quite spring, not quite winter.”

So while you’re working through the winter blues, here are some important things you can do now to set yourself up for success the rest of this year.

Let’s take a look at potential financial steps for content creators in February.

Potential Steps for Content Creators this Month

Financial steps content creators might take in February include:

- Release 1099s

- Coordinate tax documents

- Benchmark your income

1. Coordinate tax documents

If you’re wallowing in TurboTax and wondering what to do…

Or, your tax preparer looks at you like you have a third eye when you show them your YouTube statements…

We’re here for you.

We prepare taxes for creators like you to help maximize your deductions and craft a strong tax strategy for years to come.

A lot of tax preparers just fill out the forms and don’t see the story behind the numbers.

At 1Up Advisors, we’re here to read past the numbers and advise you on what the best steps are for you.

If you already have a good relationship with a tax firm, we still assist financial planning and bookkeeping clients with coordinating the documents you need to provide to them.

In the end, we absolutely recommend that you seek professional assistance on your taxes.

Because…

Knowing the correct forms to use, which deductions you can (and should) take, and all that jazz can get messy quick.

Even worse, if you make a mistake on a return, it can be costly and affect you for years to come.

This is one area you don’t want to mess with yourself, so if you want help, let’s talk!

2. Release 1099s and amend if necessary

What are 1099s?

Completing forms 1099 for vendors is a critical step for creators in January each year.

Businesses are required to complete a Form 1099-NEC (i.e. Non-Employee Compensation) by January 31 to report payments of $600 or more made over the year to each nonemployee who performed services for them.

For creators, this often includes video editors, graphic designers, etc.

Although, if you report incorrect numbers, or don’t send them at all, February is the time to act.

Psst…If your accounting isn’t organized, this might be you.

We’ve run into this before with bookkeeping clients and, while we’re cleaning up their books, we realize “uh-oh, payments to this vendor were miscategorized and didn’t show up on the 1099.”

This means you have to amend the 1099 in February and resend it to the IRS and your vendor. Depending on how long it takes you to fix the error, you may incur penalties and interest from the IRS. Penalties vary from $60 to $310 per form in 2023.

If we’re handling your books for you, we’ll track which contractors you pay throughout the year and prepare the 1099s for you at the end of the year.

3. Benchmark your income

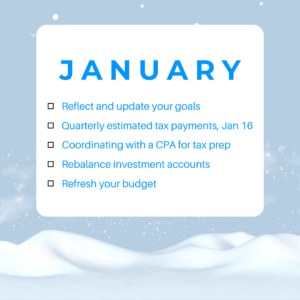

In our January steps for creators, we also touched on updating your goals for the year as a crucial step to start 2024.

One piece of that to further examine in February is how much you made last year and compare that to expectations.

It’s easy to quantify how much you made in a year – numbers don’t lie, right?

But, setting expectations and facing that dreadful word “should” (as in “how much should I be making?”) are totally subjective.

One helpful benchmark you can track to help answer this question is…

Annual growth rate

Your annual growth rate can help you see how fast your business is growing on a percentage basis.

This way, you’re comparing apples to apples.

For example, if you made $25,000 in 2021 and $50,000 in 2022 your annual growth rate is 100%.

(50,000 – 25,000) / 25,000 = 1

Then, say you make $75,000 in 2023. You’ve still been making an additional $25k each year, but this time your growth rate slows to 50%.

(75,000 – 50,000) / 50,000 = .50

This can help pull back the curtain a little more on your business

For more platform-specific metrics, check out our Comprehensive Guide to Maximizing Your Income as a Content Creator.

In Conclusion

We hope your 2024 is off to a great start!

If you’re worried about completing these financial steps, or any others you might not even know of – let’s talk!

Schedule a time below for a free consultation to review your specific situation…